When we start earning, one of the very few planning thoughts that come to our mind is home. Every one of us wants to have our own home. And when you start thinking it seriously the next question that can arise is - How Much Income do I Need to Earn to Buy a Home?

Recently I have purchased a flat and so I think I am the right person to answer- How Much Income do I Need to Earn to Buy a Home?

Buying a home is a big financial commitment and so you should plan very well. Especially when you’re planning for a big loan to purchase a house. In this post, we are going to talk about everything from the financial prospect of buying a home.

How Much Income do I Need to Earn to Buy a Home - Top points to plan

Here are some of the top points that you should consider while planning to buy a home. All these are required for big-time financial management. If you’ll ensure all these and plan properly this loan won’t be a financial burden for you.Use a mortgage qualification calculator

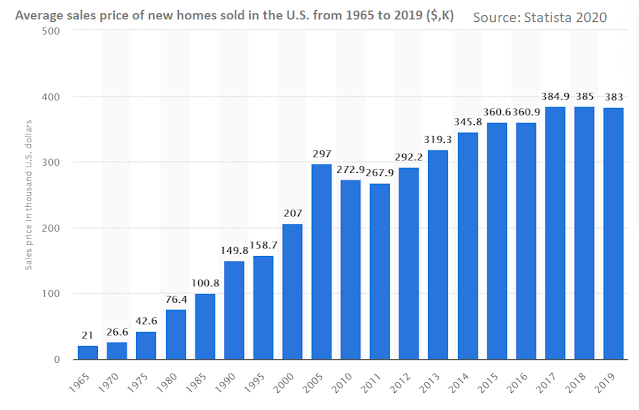

It’s always a good idea to assess your qualification before going with a big expense like buying a house or land or something bigger. In such cases, the online calculators available can help you. I have personally used the mortgage qualification calculator and understood whether I am capable enough to buy the home or not. You can find the calculator here.If you will look at the US market for a home, the average price of the home is around USD 383 K last year. Below is the trend of home pricing in the USA.

CNBC also reported the median price as $200k in 2017 and so the above figure makes sense. This way you can get an idea of how and much on average you need to arrange.

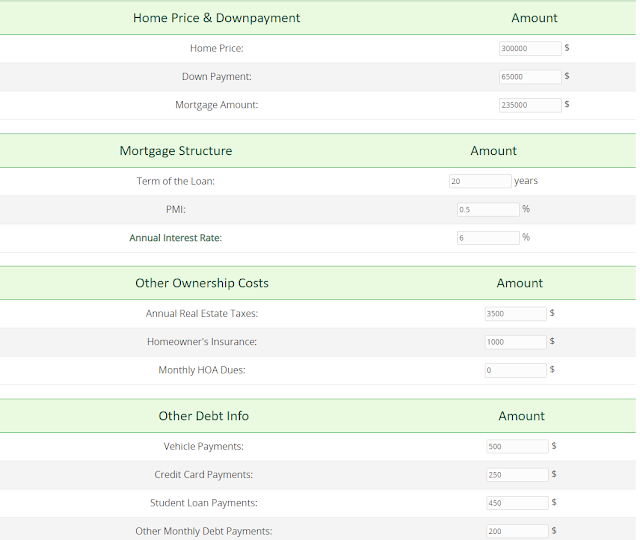

Using the calculator shared above, you can fill out all the information and get to know where you stand. For example, let’s say I am planning to buy a home of $300k at a 6% interest rate where I will pay $65k as a down payment and a loan of $235k. Then considering all other details in the form, it will show me how much I should be earning and the other details.

Here is the snippet of what I filled-

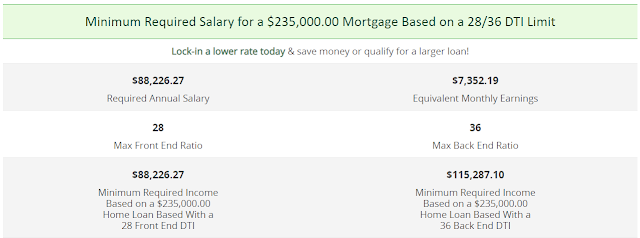

And based on my financial details and existing information, the tool is suggesting me the below requirements-

That means for getting eligible for this loan of $235k, I should be earning at least around $7k considering other factors as well. And these figures might change depending on your situation. This tool also gives you information about the current mortgage rates, a homebuyer’s guide, and more. So, if you’re struggling to decide on buying a home, you must use this calculator to better understand plan your financials.

Apart from the above-listed amount to buy a home, there are many other factors that influence home buying as well. These are not directly related to money but the qualification of the mortgage. Some of the leading factors are-

Credit score

A credit score is a value that ranges between 300-850 and the higher it is better. This score tells the financial institution about how responsible you're when you borrow money, majorly unsecured money like a loan, credit card, credit limit, etc. This is a very important factor every bank or loan issuing authority consider before approving the loan. If you have not taken any unsecured loan so far, there are high chances that you will not be approved for it.There are many other benefits of credit score as well- for example, if you have a credit score of 750+ which is considered excellent then you might even get loans at a comparatively lower interest rate. In the USA, usually lenders look for a credit score above 620, you can get a loan easily. If it is below 620, there are chances you will have to pay more interest rate. You can find more details to understand here.

There are many ways using which you can keep your credit score in a healthy range. Some of those are-

- Make all payments on time - This includes pay the loan EMI on time, pay credit card bills on time, etc.

- Pay off debt- This is one of the best ways to increase your credit score. Pay whatever you owe to the lender and close the account once paid in full.

Size of down payment

If you'll look at the above image carefully, I mentioned something called a down payment. This is the amount you pay to the homeowner yourself as you buy a home and is a part of the total cost. No lender will offer you a 100% mortgage and almost in many cases they ask you to pay around 20% yourself. This figure can vary based on location and bank rule. So, when you buy a home, make a plan on paying the down payment.Conclusion

These were all amount how much income do I need to earn to buy a home. Here we discussed the calculation and also looked at a couple of additional factors that can be important. A credit score is something which you should take seriously and also think about the down payment and plan well for it.

Tags:

Business